Many people fret about what would happen in Egypt if the Muslim Brotherhood grew in its power. According to the Chicago Tribune “with more than 43 percent of the seats in parliament, the Brotherhood is the biggest of the parties that emerged from Egypt’s most democratic elections in six decades.. Local media reports have named Khairat Shater, the deputy head of the Brotherhood, as a possible candidate for prime minister.”

As one of the founding civil society organizations responsible for a “fundamentalist Islam”, we have become used to reading about their complex history that suggests that they would institute an Islamic state. What are the images that come to mind when one thinks of an Islamic state? I would submit, that in the West, when we think of an Islamic state, we imagine an Iran-like-Theocracy or the Taliban in Afghanistan. In reality, the situation is a bit more complex and according to Tariq Ramadan it is changing.

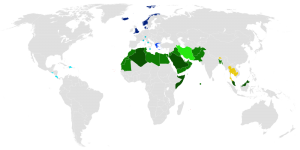

First, there are many examples of Islamic states (see below) that are not theocracies and do a decent job at democracy and maintaining the rule of law. Furthermore, Grand Mufti Gomaa of Egypt has suggested that “a civil state means a modern nationalist state that is compatible with Islamic provisions.”

According to Gomma quoted in Egypt Independent “Egypt’s religious traditions are historically linked to Islamic concepts that are based on tolerance and respect for religious differences. Egypt’s Islamic identity does not clash with its civil system, which defends citizens’ rights regardless of their faith. The mufti said the rights of Egypt’s Coptic Christians will be protected and that religious diversity should be respected.”

Second, many members of the Muslim Brotherhood and people that belong to Islamist parties in other countries are changing their rhetoric from “Islamist” to “civil”. For a neat discussion of this trend see Tariq Ramadan’s oped.

Finally, its important to remember as Dr Ramadan has pointed out that the notion of an Islamist state, as espoused by the Brotherhood was in part a response to western domination. “The state, defined as ‘Islamic’ was..the only structure that could ensure the political independence, religious identity (as opposed to secularisation, implicitly directed against Islam) and cultural specificity of the emerging Arab state entities. It was an ideological response which must be assessed in the light of the prevailing issues of the day.”

What intrigues me is how the language and rhetoric of the former Islamists is changing to be inclusive but at the same time attempts to maintain its identity separate from the west. This is as it should be.